Create Generational Wealth in Off-Market Real Estate Deals

High yield and tax-avoidance driven passive

Hands-on boots-on-the-ground management

A unique time-tested management philosophy

Hidden value in downtown underserved urban markets

Cause-Related Opportunity Zone Fund LLC

25 Complete Cycle Deals

We’ve taken 25+ deals full cycle generating IRR and equity multiples for our investors.

+40 Years of experience

Our team has 40+ years of experience in the industry of Senior Housing, Parking.

A unique management philosophy

‘Stick-to-the-fundamentals’ is proven by four real estate economic cycles.

How it Works

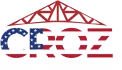

Our Real Estate Market

Market cap: $1T+

YOY growth of the market: 5%

Our Unique Market Edge

Seniors searching for high-quality housing and services will become Customers of the subject development thanks to a scarcity of other new construction in that sector of senior housing.

CROZ Fund is making a conservative estimate of an economic downturn and recovery. Parking demand and senior housing shortages will be satisfied by CROZs’ projects.

Properties are funded for long-term financial health, as the fund is attuned to the long-term benefits of cash flow surpluses being applied to the causes related to the shareholders of CROZ Fund

Why Now?

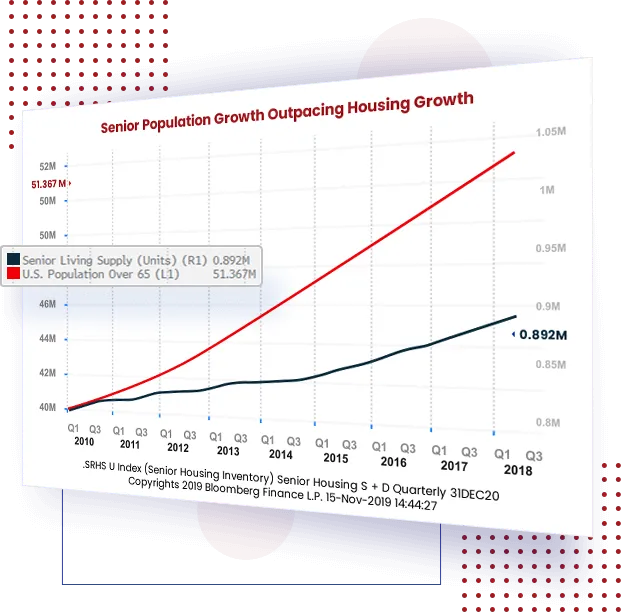

Inflation is devaluing your money

Real Estate is the best hedge against inflation

The Real Estate industry is seeing record returns

Our Vision

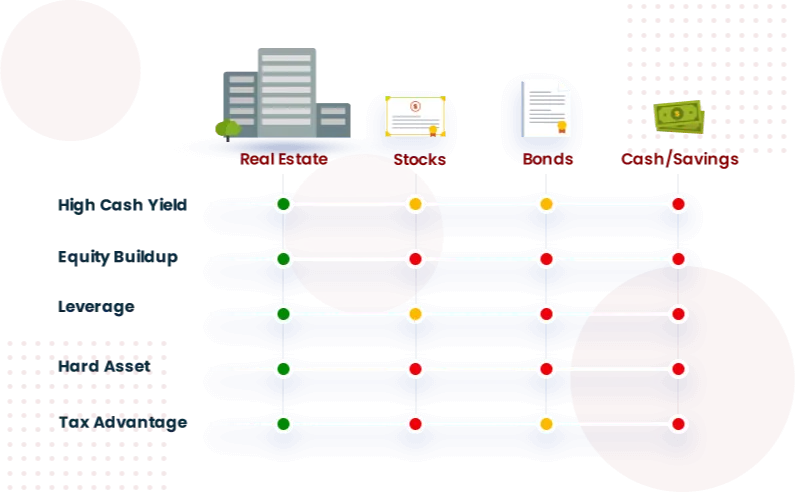

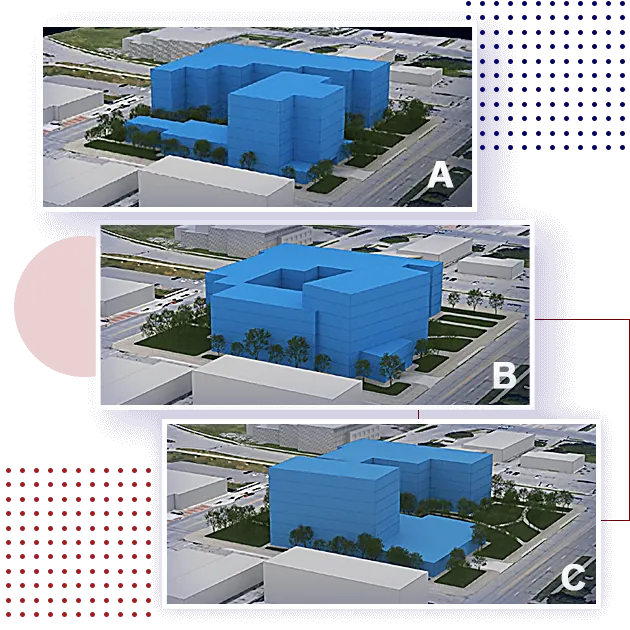

The vision of CROZ development fund is to highlight the options which the development team provides to the City of Waterloo as this is a model of how municipalities throughout Iowa and the US Midwest will save millions of tax-payer dollars.

This expanded service of a private developer creates a solution to replace negative revenue high demand parking facilities with positive cash flow assets for a variety of public uses including: Hockey arena, Sports and Recreation facilities, and the performing arts center.

Investors will join a seasoned team of nationally recognized experts that has developed a proven recession-proof industry: Revenue-generating public-private project financing, that converts under-utilized liability-side public assets into positive cash flow AND the promise of debt-free revenue generating assets for generations to come with the use of forward thinking long term loan products offered from ultra-wealthy family offices.

Join CROZ now to make a solid return on investment and a wise community impact that your children's children will point to.

About Cause-Related Opportunity Zone Fund LLC

The federal government created incentives to promote investment in distressed neighborhoods. We take this very seriously and have devoted years to planning to enter into these very specific census tracts to guide our team of investors toward meeting the needs of each local municipality we enter.

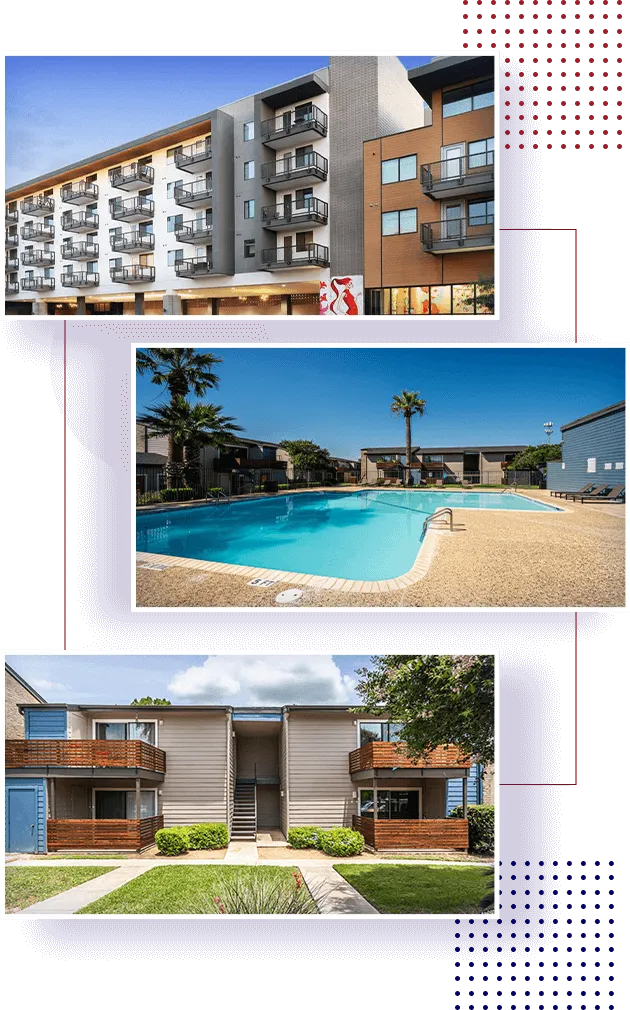

Our first projects meet Social (arts and senior citizen transportation), financial (municipal parking funding to replace expensive muni bond fundraising), and senior housing (first senior life cycle residential community that includes a mix of apartments AND memory care) in the Waterloo downtown neighborhood

Meet the team

Gilbert F. Starble

Fund Manager of CROZ

40+ Years of Experience in the Real Estate Industry

Warren C. Vander Helm

Strategic Design Partner

Parking Design Group, LLP Partner & Park Green® Managing Partner

40+ Years of Experience in The Parking Industry

Jeff Tamkin

Strategic Finance Partner

CEO of PFIC

40 Years of Experience in The Senior Housing and RE Development Finance Industry

Winston Thompson, CPA

Chief Financial Officer of CROZ

President/CEO of Thompson & Company

40+ Years of Experience in The Accounting and Finance Industry

Our Track Record

Top Financial success was the development and monetization of over $7Million in land contracts in the Houston, TX market in which a land subdivision of over 250 lots and mortgages were held and serviced for over 10 years, and was subsequently sold to a hedge fund.

Most Excitement - occurred in a small waterfront Captain's Mansion renovation project in South Boston, MA, overcame major political and social obstacles and acquired property, then repositioned it into 7 luxury townhouses, which included partial restoration and new construction overlooking Dorchester Bay.

Most Successful in Volume/Scope - working as a fee-for-service corporate buyer-broker and development consultant for a neighborhood of consolidated land parcels surrounding a Ferry Street, Everett, MA multifamily project and a similar consolidation project in the Chelsea, MA expressway redevelopment zone near the Mystic River Bridge.

Most Enduring Financial Project - as a development funding support admin vetting project feasibility and development team for a national markets tax credit investment house finding every aspect of positives and negatives to the finite detail to report Low Income Housing Tax Credit feasibility to the corporate buyer created my most enduring set of development funding skills because every decision needed to be vetted entirely in the planning stage.

Our Investment Details

FAQ

What makes Cause-Related Opportunity Zone Fund LLC a better option than its competitors?

The Development team and the funding team is seasoned and ready to weather the storms brewing ahead in the real estate industry. Our team boasts over 40 years of experience in real estate. We're not opportunistic flippers. We're seasoned developed with experience in all facets of real estate, which allows us to build projects from the ground up. Investors who come on board are expected to make handsome equity multiple once we go full cycle.

What returns can I expect from investing with Cause-Related Opportunity Zone Fund LLC?

For pre-construction phase is projected to return north of 18% IRR for our non-tax-advantaged investors within 3 years. For taxpayer-investors who suffer from eligible capital gains taxes will benefit from OZ tax advantages, and projections show IRR over 25% over the 5 year deferral period, and even higher over the 10 year (capital gains tax) elimination period. Inflation is devaluing your money. Join a team with 4 Boom-Bust Real Estate cycles under their belt. Learn the little-known investment method that ultra wealthy family offices have known for decades to profit from downward sloping real estate markets, and deployed by the CROZ Fund in today's economy.

Why is now the time to invest with Cause-Related Opportunity Zone Fund LLC?.

Inflation is devaluing your money, and Real Estate is historically the best hedge against inflation. The timing of CROZ Fund's success formula is simple, and yes, it is certainly little-known in conventional real estate development circles. The CROZ Fund leverages lower cost of development funds and the longer term amortization periods from the private sector that competes favorably against the municipal bond market thanks to their strategic partnering with the City of Waterloo to deliver parking assets and services. CROZ Fund enjoys the very best timing considering the precious scarce availability of its essential services and its debt.

Are You Looking to Achieve Financial Freedom?

That is, the ability to focus on your own business, your passion projects, travel around, or even just the peace of mind of being able to spend time with your family and friends, without money being a limiting factor. This puts you in the same category as the

vast majority of people.

And yet, very few are actually able to achieve such freedom. This is because most people trade their time for money. Even if you own a business that generates money, or you get paid handsome wages, as long as your net worth is limited by the time you dedicate to generating it, you may never truly be “free”.

And I know that this is why you turned to passive investment.

Which creates a new problem: where do you invest? Do you go for the volatile stock market and crypto, and endure the risk? Do you play it safe but get modest returns that don’t really move the needle for you in terms of creating wealth? For most investors, there always seems to be a tradeoff between risk and return.

But I’m here to tell you that it doesn’t have to be this way. There actually IS a way to invest safely, and yet, make very good returns along the way. This can be achieved in commercial real estate if you know where to look…

Hear me out:

Real Estate has traditionally been the safest investment space, as property tends to appreciate with time. And at the same time, Real Estate has created more millionaires than any other sector. The problem is that the price of entry is usually quite high, and if you’re doing it on your own, you’ll need to do a thorough market analysis, and be very hands-on with the management of your investment.

None of this is easy to do. And it wouldn’t create the freedom you want.

This is why Cause-Related Opportunity Zone Fund was founded. What we do is allow investors to invest in making a difference in the community by investment into distressed neighborhoods.

Traditionally, this type of investment has only been limited to selected circles. But what we did is lower the price of entry, in terms of price and knowledge, and completely eliminate the need for you to be involved. In other words, no more trading your time for money.

But let’s just slow down, because I don’t want you to take my word for it…

Our projects meet Social (arts and senior citizen transportation), financial (municipal parking funding to replace expensive muni bond fundraising), and senior housing (first senior life cycle residential community that includes a mix of apartments AND memory care) in the Waterloo downtown neighborhood.

And here’s why it works:

Properties are funded for long-term financial health, as the fund is attuned to the long-term benefits of cash flow surpluses being applied to the causes related to the shareholders of CROZ Fund. Now you could be thinking one of two things: you either tried real estate before and it didn’t work out, or you never tried it and are skeptical about investing your money in a space you know nothing about.

If you’ve tried Real Estate before and it didn’t work out, then that doesn't change the fact that this is STILL the safest investment sector, and it STILL creates millionaires every year. This means that the problem was you either trusted the wrong company, or you didn’t do your thorough research.

If this is a new space for you, then know that we don’t just multiply your money. As a matter of fact, we educate you every step of the way. We teach you about the industry, we provide you with explicit details about every investment, and we’re always there to answer any question you have, no matter how big or small.

This means that when you invest with Cause-Related Opportunity Zone Fund, you're not only creating wealth, you're not only achieving freedom, but you’re also learning and gaining awareness about the Real Estate industry. The kind of knowledge you could use on your own, or pass down to your children.

And now I’m giving you the opportunity to join us, and create a stable, passive source of income for you and your family.

Something that will last forever. Your legacy.

Schedule a call with us now and let’s talk business.